今天在玩ChatGPT AI,他给我做了首古诗词,还怕我文盲给我解释了一下

patrician • • 98 次浏览

水平一般般,但是有一股骚气在那里,哈哈。

-

patrician 楼主#1

另外帮我写了个关于跨境支付的white paperCross border remittance in Southeast Asia presents both challenges and opportunities for individuals and businesses. As a region with a high level of economic integration and a growing middle class, Southeast Asia has seen an increase in the need for cross border money transfers. However, the lack of standardized regulations and the presence of traditional financial institutions have made it difficult for remittance service providers to operate efficiently and securely. In addition, the rise of digital currencies and fintech companies has disrupted the traditional remittance industry, creating both challenges and opportunities. This white paper will explore these challenges and opportunities in detail, and provide recommendations for addressing them.

One major challenge for cross border remittance in Southeast Asia is the lack of standardization and harmonization of regulations across the region. Each country has its own set of rules and regulations governing remittance services, making it difficult for remittance service providers to operate in multiple countries. This lack of standardization also creates inefficiencies and increases the cost of remittance services, which ultimately affects the end user.

In order to address this challenge, it is important for governments and regulators in Southeast Asia to work together to develop and implement standardized regulations for remittance services. This could include establishing common standards for licensing and compliance, as well as working towards the creation of a regional payment network that would facilitate cross border money transfers.

Another challenge is the dominance of traditional financial institutions, such as banks, in the remittance industry. These institutions have long held a monopoly on remittance services, making it difficult for new entrants, such as fintech companies, to compete and offer more innovative and cost-effective solutions.

One solution to this challenge is for governments and regulators to promote competition in the remittance industry by creating a level playing field for traditional financial institutions and fintech companies. This could include providing equal access to payment systems and customer information, as well as implementing regulations that are equally applicable to both types of companies.

The rise of digital currencies and fintech companies has also disrupted the traditional remittance industry, creating both challenges and opportunities. On the one hand, digital currencies and fintech companies have introduced more efficient and cost-effective remittance solutions. On the other hand, the lack of regulation and oversight in the digital currency space has raised concerns about the safety and security of these services.

To address this challenge, it is important for governments and regulators to develop a clear and comprehensive regulatory framework for digital currencies and fintech companies. This could include implementing consumer protection measures, such as requiring these companies to hold reserves and maintain minimum capital requirements, as well as establishing clear rules for the prevention of money laundering and terrorist financing.

One opportunity for cross border remittance in Southeast Asia is the potential for increased financial inclusion. With the growth of the middle class and the increasing use of mobile phones and the internet, more people are gaining access to financial services and are able to participate in the global economy. This presents an opportunity for remittance service providers to reach underserved populations and provide them with access to affordable and convenient money transfer services.

In order to take advantage of this opportunity, it is important for governments and regulators to promote the development of inclusive financial systems that provide access to financial services for all segments of the population. This could include implementing policies that promote the adoption of mobile and digital financial services, as well as providing support for the development of infrastructure and technologies that enable access to financial services in remote and underserved areas.

Another opportunity is the potential for increased trade and investment within the region. As cross border remittance becomes more efficient and cost-effective, businesses and individuals will be able to more easily send and receive payments across borders, facilitating increased trade and investment within Southeast Asia.

To take advantage of this opportunity, it is important for governments and regulators in Southeast Asia to work together to create a conducive environment for trade and investment. This could include implementing policies and initiatives that promote regional economic integration, such as the creation of free trade agreements and the establishment of common standards and regulations for cross border transactions.

Overall, cross border remittance in Southeast Asia presents both challenges and opportunities. To address these challenges and take advantage of the opportunities, it is important for governments, regulators, and the private sector to work together to develop standardized regulations and promote innovation in the remittance industry. This will require a coordinated and collaborative effort, but the potential benefits for the region's economy and its people make it a worthwhile endeavor. -

patrician 楼主#2

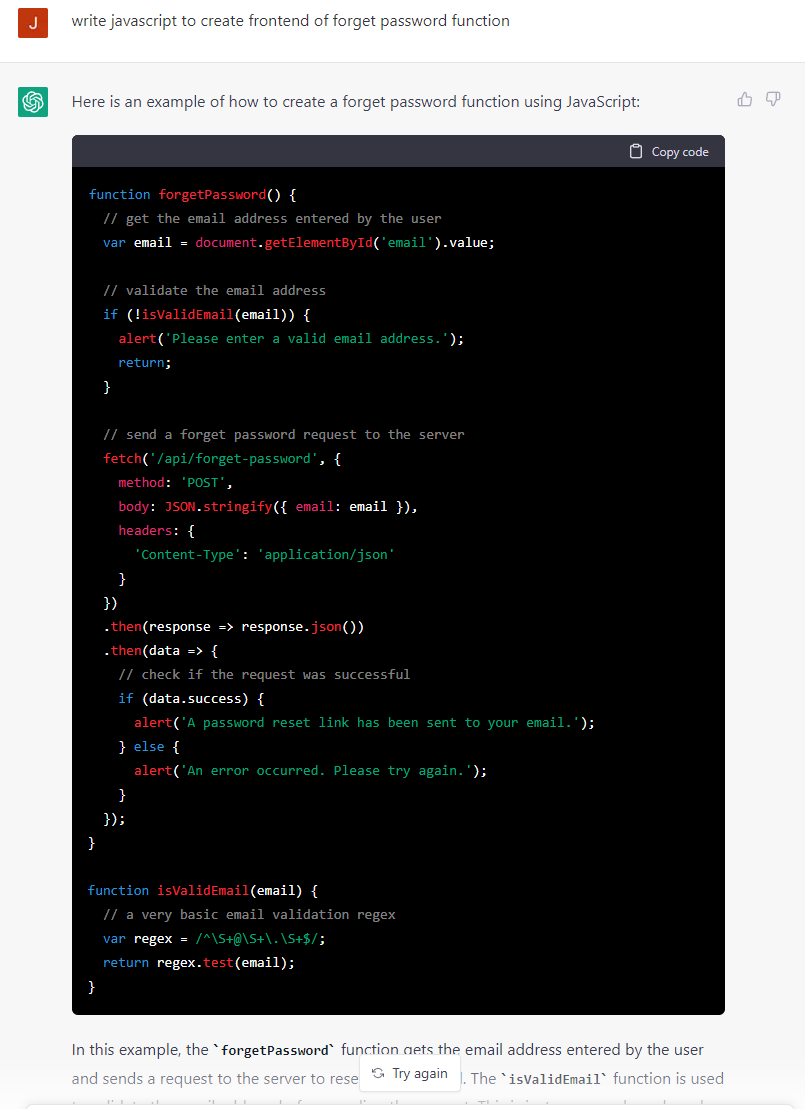

还给我写了个忘记密码的前端程序

-

patrician 楼主#3

感叹一下,AI正在慢慢的进入以及改变人们的生活

-

#4

我比较俗只想问问哪个股票会涨。